Telcos in India, Vietnam, PH face growth opportunity amidst connectivity gap

Study cites millions of untapped customers as targets of digital inclusion.

More than 600 million people living in India, Vietnam, and the Philippines “can’t afford to join the digital economy” and are still offline, according to the inaugural B-Gap Barometer report released by cloud and mobile technology firm CloudMosa.

Explaining the term “B-Gap” in its study, CloudMosa pointed to the necessary elements in setting digital inclusion targets. It said: “Achieving digital inclusion requires A) connectivity plus B) affordable devices capable of accessing the modern internet and app ecosystem.

“In many markets, connectivity has advanced, with 2G and 3G networks being phased out. But without affordable, capable devices, millions are locked out of progress. This is the heart of the B-Gap: the missing link between existing infrastructure and the people who can’t afford to use it.”

The report, which cited affordability as “the most persistent obstacle,” published the following findings based on responses from senior telecommunications executives in the three countries:

- In India, 41% of the population remain offline; in the Philippines, 26%; and in Vietnam, 21%.

- More than half (58%) of telco leaders in the Philippines see consumer affordability on devices as a major issue in transitioning users from 2G; 54% in India; and 51% in Vietnam.

- When it comes to the affordability of data plans, 66% of those polled in the Philippines consider the consumer cost a top concern, followed by Vietnam’s 57% and India’s 51%.

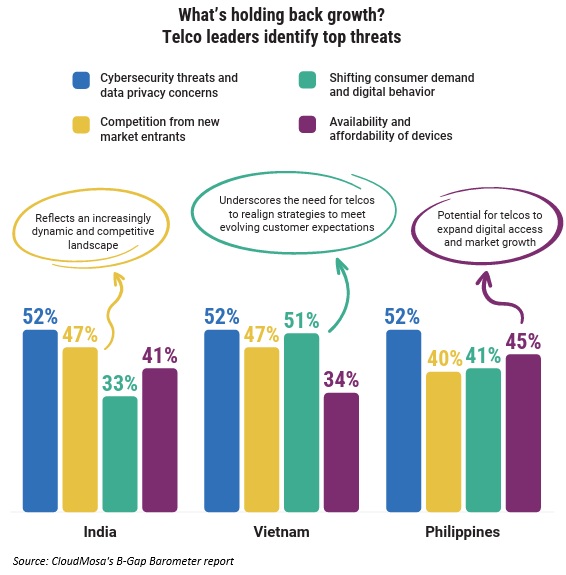

CloudMosa, which fielded its March to April 2025 survey in partnership with Rakuten Insights, also found that aside from the availability and affordability of devices, key barriers to growth similarly include cybersecurity threats and data privacy concerns, competition from new market entrants, and shifting consumer demand and digital behaviour.

So, how are telecom stakeholders in these “digitally ascending” economies approaching the challenge?

“Increasingly, telcos and governments are rolling out initiatives that prioritise digital inclusion, with market players in all three countries expressing a high commitment to ensuring connectivity for underserved populations,” noted CloudMosa – the name behind Cloud Phone, which converts basic handsets into internet-capable devices.

“Forty-eight percent (48%) of respondents across the three markets prioritise digital inclusion programmes because they support regulatory compliance and government initiatives. Across all markets, 92% see aligning with government affordability initiatives as a significant benefit of prioritising digital inclusion and expanding affordable connectivity.”

In the Philippines, for instance, the first phase of the country’s National Fibre Backbone plan was launched in 2024, with the goal of boosting internet connectivity.

At the time, President Ferdinand Marcos Jr. said: “To all my fellow public servants, my challenge to you is to spread these initiatives to all corners of the Philippines, especially to those who remain without access to the internet. Let us persist in pushing the boundaries of what is achievable – collaborating, innovating, and adapting wherever possible to ensure that every Filipino is empowered in this digital era.”

In Vietnam, amongst the targets is for all citizens to own affordable smartphones by 2025. In India, the nation’s Digital India initiative has been in place since 2015.

Given the market numbers and the increased focus on connectivity, CloudMosa believes telcos in emerging markets face significant growth prospects.

“Digital inclusion is no longer just a CSR (corporate social responsibility) exercise or compliance obligation but a strategic imperative,” the company highlighted. “It’s increasingly seen as an exciting business opportunity that signals the potential for revenue growth and market expansion.

“Actively pursuing inclusion is an obvious way to reach untapped customers and increase average revenue per user by expanding participation in the digital economy. It’s also an important factor in building and maintaining a strong brand. Almost all industry players (97%) across the three markets surveyed pointed to digital inclusion as a central component of their business strategy.”

For CloudMosa CEO Shioupyn Shen, the B-Gap presents a “real” market opportunity.

“Telcos are racing to the future with 5G, but growth won’t come from the top alone,” Shen said. “The real opportunity lies in those being left behind in the migration to 4G and beyond. This report is a call to action for industry leaders: those who move first to bridge the affordability gap will shape the next decade of the industry.”

According to the report, 95% of telcos in India implement digital inclusion programmes, while the corresponding figures in the Philippines and Vietnam stand at 87% and 69%, respectively.