APAC telcos turn to consolidation to compete with market leaders: S&P

Fewer market players reduce the need for overlapping infrastructures, resulting in savings.

More telecommunication companies are consolidating in Asia to better compete with the dominant players and survive economic headwinds, but other nations run the risk of high market concentration, according to S&P Global Market Intelligence.

S&P is seeing opportunities for further market consolidation in the still fragmented markets of Indonesia and Malaysia, while a recently approved megamerger in Thailand has reduced the market into a duopoly.

“Hefty capital investments in 5G, fiber and digital transformation, coupled with a higher cost of capital due to rising interest rates have put operators in Asia-Pacific in a tight spot at a time when they should be focusing on monetizing 5G,” the report said. “To better compete with market leaders, some relatively smaller operators have agreed to merge to save costs and redirect capital toward debt reduction and new investments.”

Highly concentrated markets, however, may result in companies gaining strong pricing power to the detriment of consumers, S&P added.

Indonesia saw its second-biggest telco, Indosat Ooredoo Hutchison, officially formed early last year following the $1.18b merger of Qatar-based Ooredoo QPSC and Hong Kong-based CK Hutchison Holdings.

The deal, which closed in January 2022, merged the country’s previous second- and fourth-largest operators into a major player that could better compete with Telkomsel. The research also noted how Ooredoo’s creation eliminates the pricing pressure in the market that had been resulting in narrow margins for operators.

In Malaysia, the merger between Celcom Axiata and Digi.com in a $3.78b deal that closed last November formed Celcomdigi, which was catapulted to become the country’s leading operator accounting for 46% of the market.

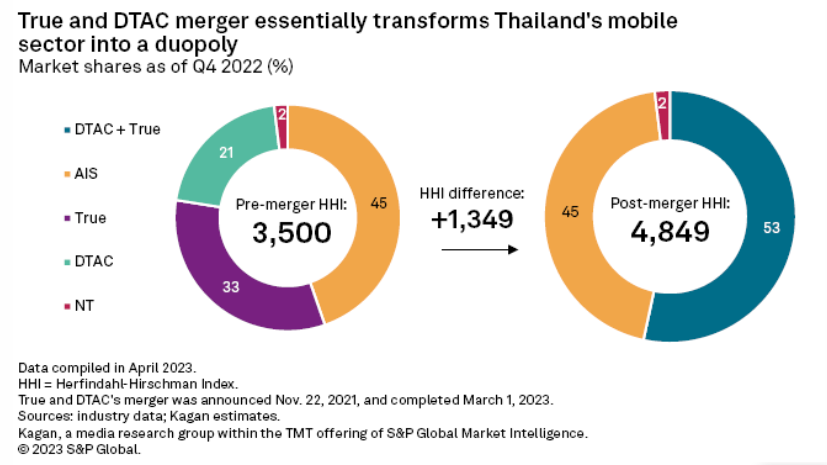

Thailand witnessed the biggest yet most controversial consolidation among the four countries studied, considering the $5.53b merger between True Corp. and Total Access Communication that was completed in March. With a combined market share of 53%, the combined entity dominates the Thai mobile industry together with the previous leader, Advanced Info Service which services about 45% of the market.

“A duopoly is undesirable in the context of market competition since it creates monopolistic characteristics and concentrates market power — think pricing and limited consumer choice in particular — or market collusion,” S&P said, noting that the merger raises the chances of price hikes for mobile services in the country.

In Taiwan, there are two pending merger deals that might see its existing five operators get consolidated into three major players, depending on which proposal will get the final nod from regulators.