Global semiconductor industry to hit up to $2.4t by 2040

AI is driving investment and demand, but gains remain uneven across the sector.

The semiconductor industry is amongst 18 sectors expected to reshape the global business landscape, with its value projected to reach between $1.7t and $2.4t by 2040, according to the McKinsey Global Institute.

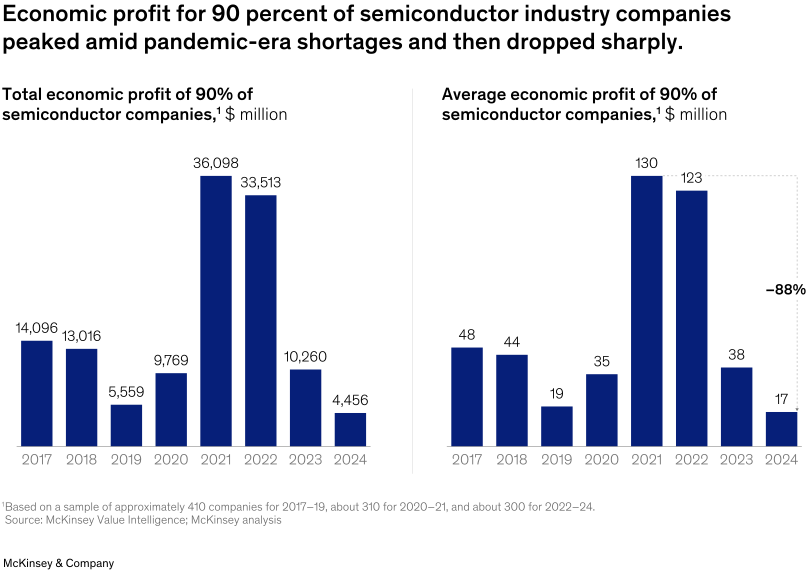

Whilst AI’s technological requirements are driving a significant amount of investment and demand to the sector, the gains are not evenly distributed across the industry. A small group of companies—representing just 5% of the sector—generated all of the industry’s economic profit in 2024. Meanwhile, the remaining 95% saw a sharp decline in value generation.

Here’s more from McKinsey & Company:

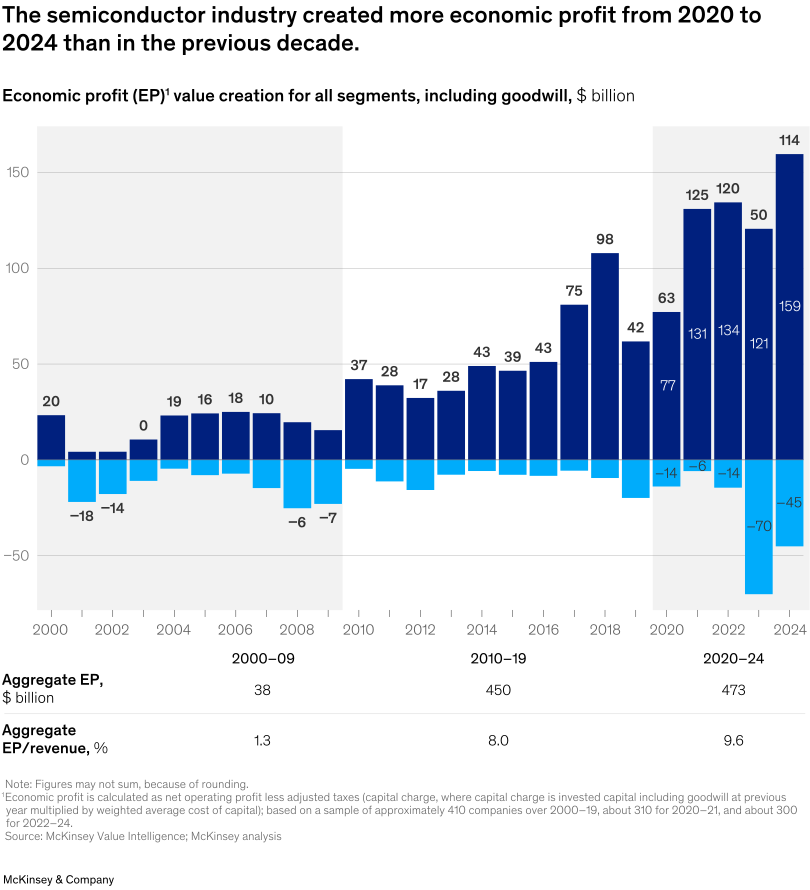

Economic profit growth in the industry has been strong. Relative to other industries in the top 30 for average economic profitability, the semiconductor sector has progressed significantly, going from 15th place in 2000–04 to fourth place in 2016–20 and third place in 2020–24.3.

In its first decade, the industry made around $38b in economic profit, most of which was contributed by Intel. In its second decade, the industry matured and scaled up the foundry model, with the emergence of new technologies, such as smartphones, creating new avenues for growth beyond computers. As a result, profitability surged to $450b between 2010 and 2019.

Moreover, the industry generated an aggregate economic profit value of $473b between 2020 and 2024, with the surge primarily attributed to the growth in AI and new applications for semiconductors in markets like automotive and industrial. Part of this surge also came from unusually high profits during pandemic-induced product shortages.

However, the sector has seen a divergence in value generation. In 2023 and 2024, the top 5 percent of industry players—led by Nvidia, TSMC, Broadcom, and ASML—generated $121b and $159b in economic value, whilst players in the bottom 5 percent of economic value generation lost $45b to $70b.

Nonetheless, the current state of the sector in aggregate cannot be explained solely by examining the outsize impact of the top economic value generators in the earliest and most recent market phases. A deeper analysis is needed to address widespread industry issues.

For example, viewing economic profit in terms of industry players in the top 5 percent, middle 90 percent, and bottom 5 percent of economic value generation brings industry dynamics into sharper focus: In 2024, the top 5 percent of companies generated $147b in economic profit, the middle 90 percent generated only $5b, and the bottom 5 percent lost $37b.

From 2021 to 2022, the middle 90 percent of the industry experienced a sharp rise in economic value generation linked to pandemic-related shortages. However, the effects of the pandemic on the middle 90 percent of companies were temporary; by 2024, their economic value generation had fallen from a 2021 average of $130m per company to below pre-pandemic levels at $17m.