How telcos can position themselves in the AI economy

McKinsey noted four main paths that telcos must pursue to balance ambition and risks.

As businesses and governments ramp up AI adoption, telecom operators are weighing how to position themselves in this market.

According to McKinsey, there are four main paths that telcos could pursue—individually or in combination—and potential considerations that leaders can weigh to balance ambition with a clear-eyed understanding of the associated risk.

Path 1: Connecting new data centres with fibre

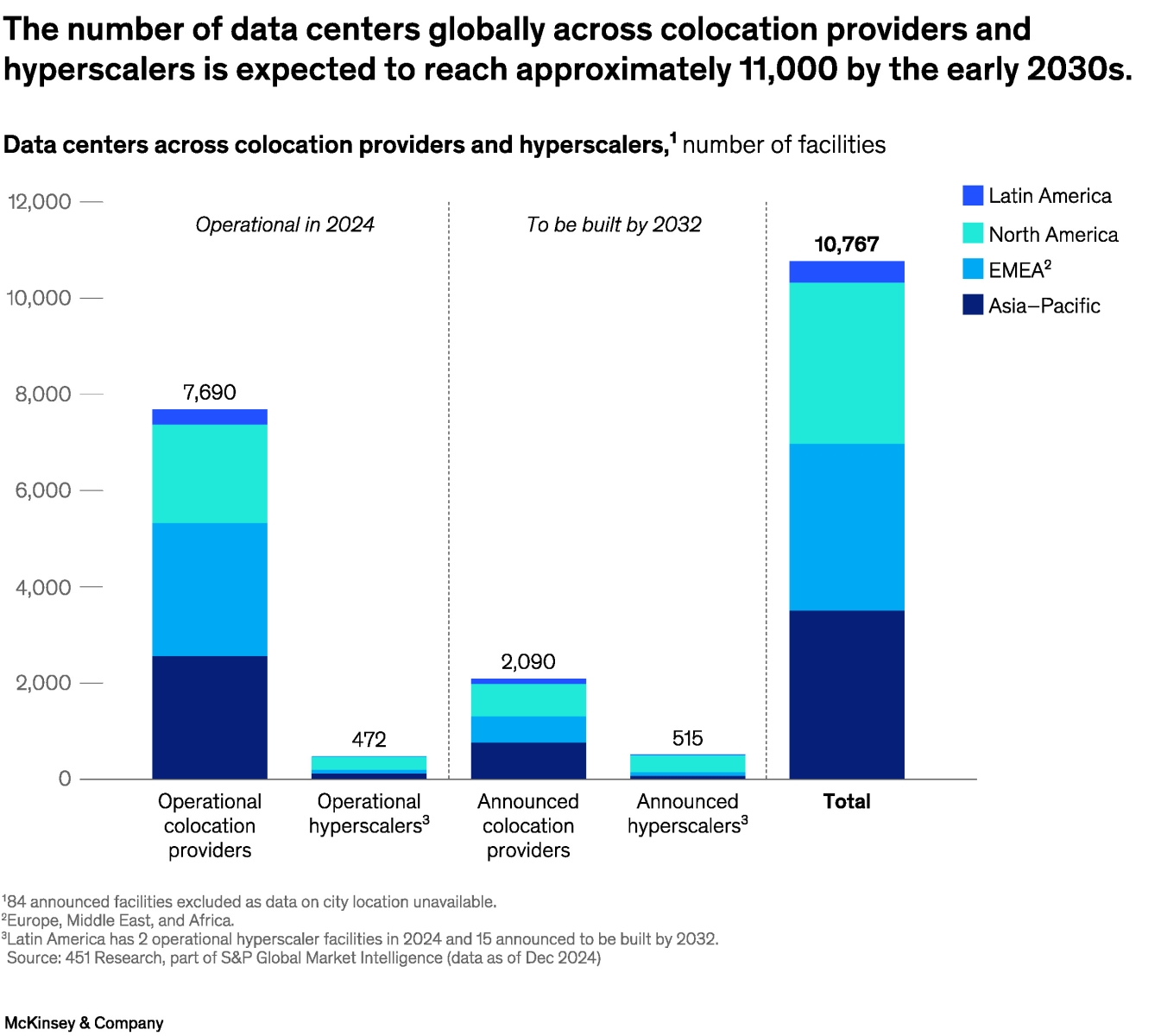

The report noted that the rapid expansion of AI computing has triggered a wave of data centre construction, with over 2,600 new facilities planned worldwide. Roughly 25% of them will be built in cities currently lacking any data centre presence.

By the early 2030s, colocation providers and hyperscalers are expected to operate nearly 11,000 data centres worldwide.

However, colocation providers and hyperscalers must also connect the data centres via fibre to scale AI workloads for customers.

McKinsey’s research finds that this demand will create at least a $30b to $50b global market opportunity.

Path 2: Enabling high-performance cloud access with intelligent network services

As enterprises run AI workloads on the cloud and their business requirements become increasingly complex, they will need intelligent network services that give them more flexibility and control in managing the network.

These services can help enterprises rein in cloud data transfer fees, which are estimated to exceed $70b to $80b annually.

This opens a door for telcos to offer intelligent networking services that allow customers to control and optimise their data flows, potentially reviving B2B revenues that have declined over the past decade.

Still, the market remains undefined, and telcos will need to invest in product development and customer research to stay competitive.

Path 3: Turning unused space and power into revenue

Another low-risk route for telcos, particularly in the U.S. and Europe, is repurposing existing space and power capacity to host AI operations.

McKinsey highlighted that in Asia-Pacific, operators will likely consider this path low-hanging fruit, given their strong presence in the data centre business.

As telco leaders seek to turn assets into revenue-generating income, prioritising their efforts for the first few deals around facilities that need little retrofitting or adapting a facility only after they obtain a firm commitment from future tenants may help mitigate their risk.

Path 4: Building a new GPUaaS business

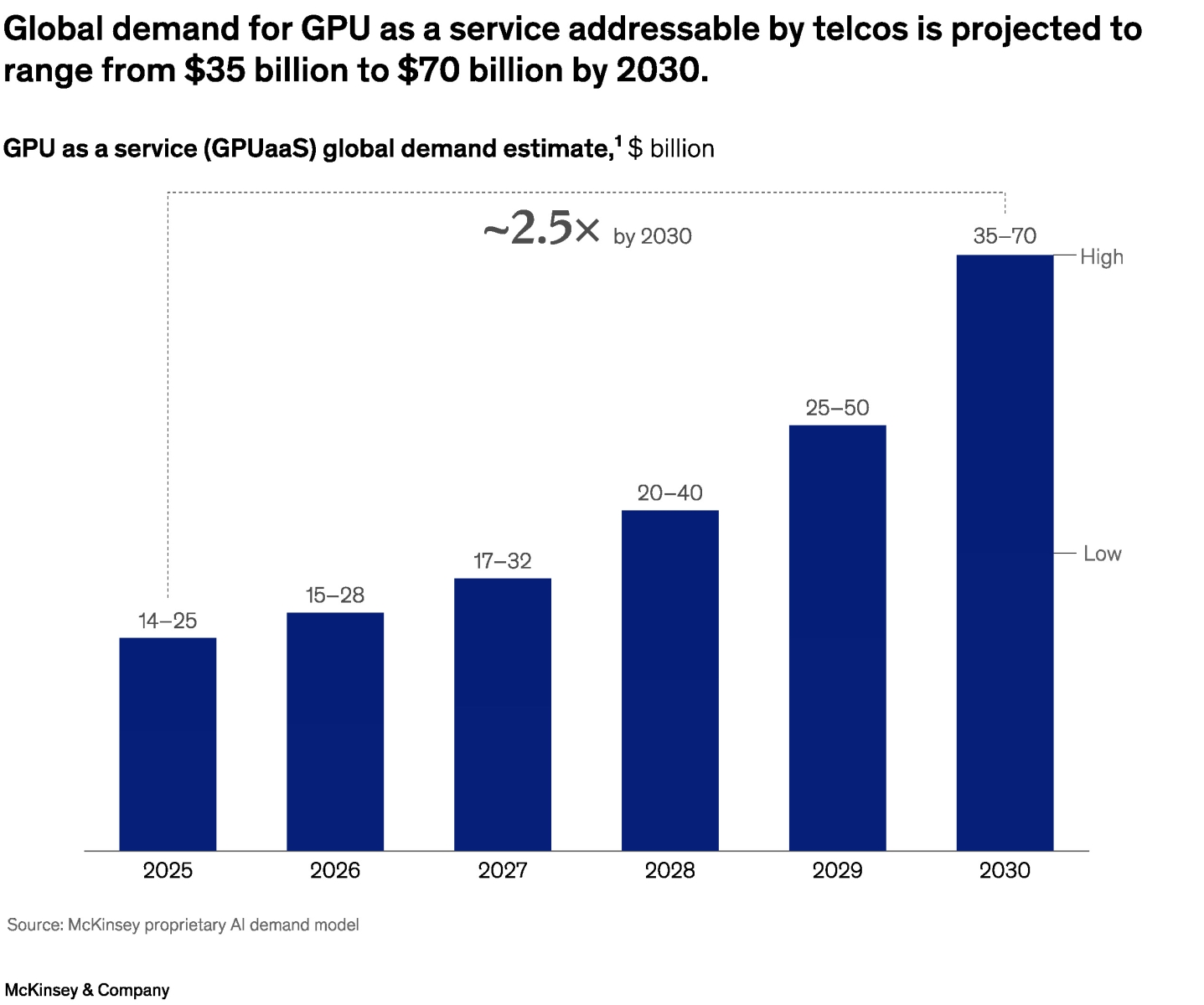

The report noted that GPU-as-a-service (GPUaaS) offerings allow organisations to gain remote access to high-performance GPUs hosted in AI-ready data centres without costly up-front investment.

GPUaaS providers rent GPU compute using flexible pricing models, such as by the hour or for a longer term. Such offerings can provide access to large-scale GPU clusters for public-sector use cases, including sovereign AI; enterprise training of AI models; or delivery of small GPU clusters close to users for AI inferencing.

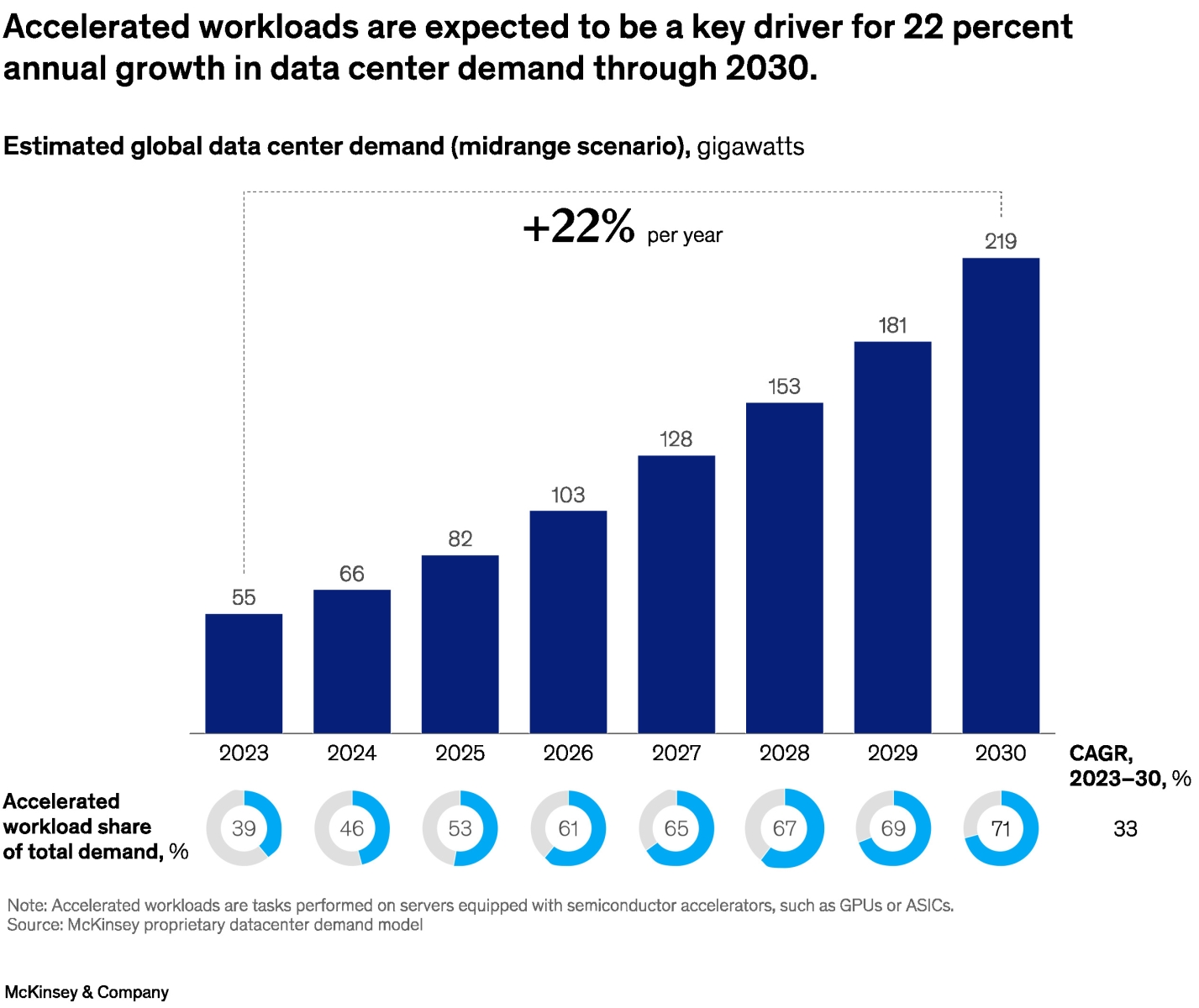

This can potentially be an attractive opportunity: Accelerated compute workloads, including for AI and gen AI, are expected to grow at more than 30% CAGR and could make up more than two-thirds of data centre demand within the next five years.

McKinsey suggests that the addressable GPUaaS market addressed by telcos could range from $35b to $70b by 2030 globally.

For telcos that have delayered or sold their data centre, leasing data centre space for GPUaaS can be an effective approach to capitalising on the opportunity without investing in new facilities.