Mobile operators may struggle to justify higher prices for business mobile services

This can be addressed by differentiating pricing gaps between basic and premium plans.

Mobile operators are looking for ways to increase the Average Revenue Per User (ARPU) of their business mobile services, but they may face difficulty justifying higher prices to customers who already have large or unlimited data allowances. To address this problem, some operators are creating a significant pricing gap between their cheapest basic plans and their most expensive premium plans, and offering differentiating features to justify the higher price.

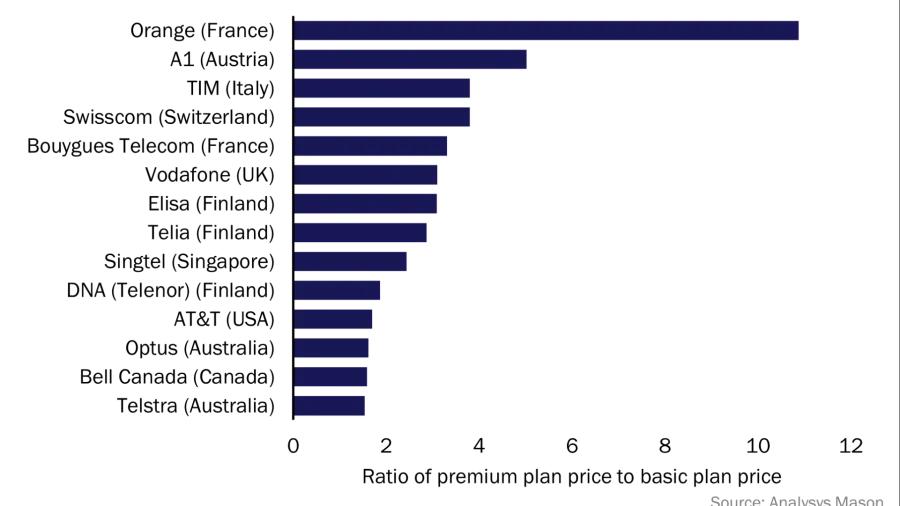

Orange (France), A1 (Austria), TIM (Italy), and Swisscom (Switzerland) are among the operators that have created the largest pricing gaps between their basic and premium plans, with Orange's premium plans costing between EUR40 per month for 150GB of data and EUR133 per month for 300GB of data.

These operators are differentiating their premium plans with features such as unlimited data, 5G access, faster download/upload speeds, better voice/SMS roaming coverage, service discounts, and value-added services, Analysys Mason reported.

Read more: Vietnam's mobile service revenue to grow at 5.7% CAGR by 2027

These premium features are helping operators justify the higher cost of their premium offerings and capture high-value SME customers who demand enterprise-like care from their providers.

According to a recent study of 14 operators, 5G network access is one of the most commonly used tools to differentiate between premium plans and basic plans. However, small and medium-sized enterprises (SMEs) have indicated that 5G services are less of a priority than other features, but over a third of SMEs will prioritize 5G when making mobile plan choices nonetheless. Orange, for example, only offers 5G to its premium plan subscribers.

Operators can increase ARPU by extending their portfolios of mobile business plans to include higher-priced packages with a number of upgraded features such as larger data allowances, faster speeds, broader geographical coverage, and value-added services.

Ensuring that their basic plans differ significantly from their premium plans will help operators capture high-value SMEs. Entry-level plans that are deliberately unattractive may also encourage customers to consider more-expensive options.

"Operators will increase their chances of capturing high-value SME customers by ensuring that their basic business mobile plans differ significantly from their premium plans," the report read.

The study also found that operators can either offer mobile plans with high pricing ratios to increase ARPU or keep the ratios low to win market share. Operators with a small difference between the price of their most expensive plan and their cheapest plan include Telstra (Australia), Bell Canada, Optus (Australia), and AT&T (USA).

Operators can capture high-value SME customers by creating a significant pricing gap between their basic and premium plans, differentiating their premium plans with features that justify the higher cost, and extending their portfolios of mobile business plans to include higher-priced packages with upgraded features.