Smartphone shipments in Southeast Asia dip in Q2

Market leader gets 19% share of units shipped.

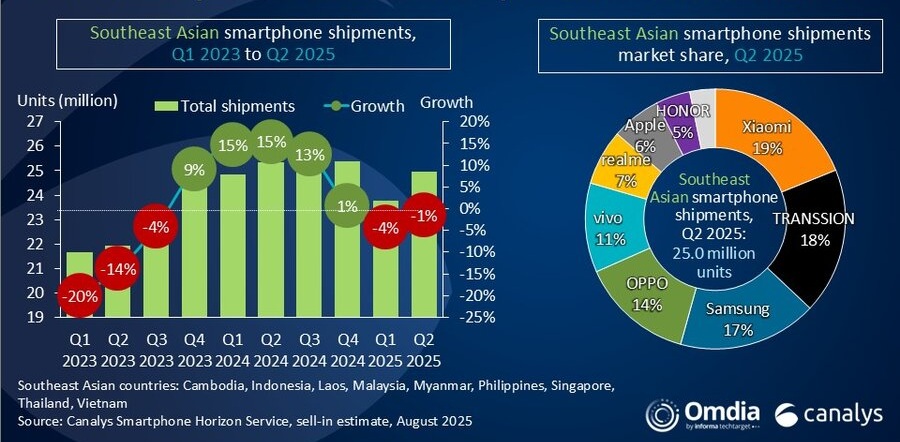

The smartphone market in Southeast Asia saw a 1% drop in shipments in the second quarter (Q2) of 2025 compared to the same period in 2024, according to data published by Omdia-owned technology market analyst firm Canalys.

Of the 25 million units shipped in Q2, an estimated 19% (4.7 million) came from Xiaomi, including its POCO sub-brand. Xiaomi's quarterly standing represented a return to the top since it led the market four years ago.

Second in terms of market share was TRANSSION with 18%, followed by Samsung with 17%. Excluding OnePlus, OPPO took a 14% slice of the Q2 shipments, while vivo captured 11% of the market.

Canalys Research Manager Le Xuan Chiew explained: "Xiaomi's Q2 2025 performance was driven by the expansion of its direct-to-consumer and operator channels, creating a solid foundation to scale its sub-brands; POCO shipments more than doubled, whilst the premium Xiaomi 15 series grew 54% year on year, a milestone for a brand long perceived as a budget flagship.

"Samsung likewise strengthened channel diversification and premium positioning by expanding its enterprise strategy, an advantage rooted in its legacy as a trusted partner to large enterprises and government sectors.

"This reflects Samsung's growing focus on vertical integration and B2B (business-to-business) engagement, setting it apart from competitors whilst supporting higher ASPs (average selling price) and unlocking cross-device revenue beyond traditional retail channels."

It was noted that Xiaomi's market share in the quarter signified an 8% uptick from 2024. TRANSSION's share of the shipments grew by 17%, whilst Samsung, OPPO, and vivo posted decreases of 3%, 19%, and 21%, respectively.

Read more: How many smartphone units were shipped in SEA in Q4?

Commenting further, Chiew said: "The ongoing US-China trade tensions are creating significant knock-on effects, as vendors realign supply chains away from China to prioritise shipments for the US.

"This inevitably impacts production and stock allocation from manufacturing hubs such as China and Vietnam to both Southeast Asia and the US, disrupting inventory planning and constraining product availability.

"At the same time, currency volatility, particularly a weakened US dollar, is influencing local purchasing power and retail pricing, forcing vendors to adjust prices or promotions to remain competitive."

Meanwhile it was highlighted that the rapid expansion of TikTok Shop into electronics is providing new growth prospects for smartphone providers in the region.

"Brands like Infinix (owned by TRANSSION) and Xiaomi are already witnessing success using TikTok Shop to sell lower-priced online-exclusive models and clear older inventory with aggressive discounts and live-selling events," Canalys Senior Analyst Sheng Win Chow stated.

"The expansion of a third major e-commerce player willing to support discount subsidies and advertising spend presents a significant opportunity for smartphone vendors in an increasingly competitive market."