Telcos ramp up M&A deals ahead of 'next era'

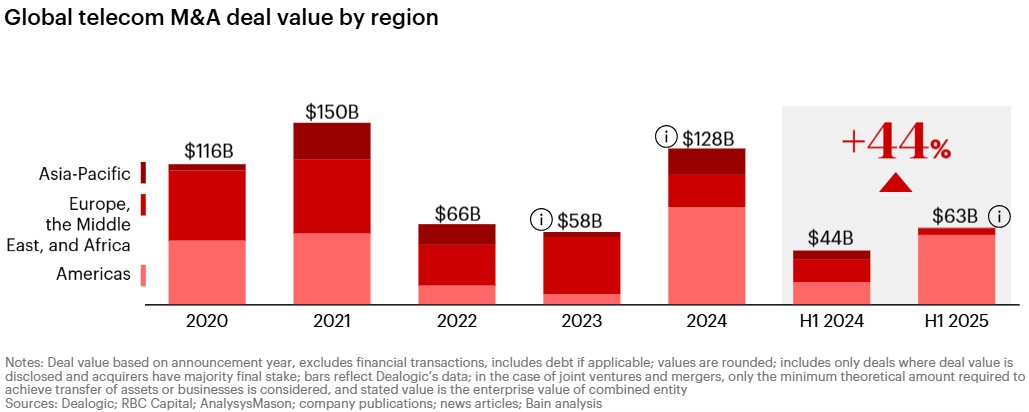

Global value sees huge leap to $47b in Q2 of 2025.

In the first six months of 2025, the global value of mergers and acquisitions (M&A) in the world of telecommunications amounted to $63b, according to data monitored by Bain & Company. Of the half-year sum, $47b came from deals in the second quarter (Q2).

"Telcos are acquiring companies to gain scale and expand reach, especially in the US (e.g., the Charter–Cox Communications and AT&T–Lumen Technologies deals)," Bain noted. "Other telcos are exiting volatile or non-core markets, as with Telefonica's announced sales of its subsidiaries in Peru, Uruguay, and Ecuador."

In Bain's quarterly report, the management consulting firm pointed to the near tripling of the global telecom M&A value from the first quarter's $16b. It also highlighted the 44% jump when comparing the first half of 2025 with the corresponding period in the previous year.

Breaking down the numbers, Bain said: "Big deals are generating the momentum: Of the 35 transactions announced so far this year, the top five deals represent more than 80% of total value. Charter's $34.5b acquisition of Cox Communications accounts for more than half of global value this year...

"After a decline in the first quarter, scale deals came roaring back. They now account for 70% of global deal value this year, up from 38% in the first half of last year."

Scale deals refer to M&A transactions that are primarily aimed at increasing sector-specific market share. According to Bain, this particular deal type accounts for approximately 43% of all deal value over the past five years.

"Facing unprecedented industry transformation and emerging competitive threats, many telecommunications companies are turning to mergers and acquisitions to add new capabilities and evolve their businesses for the next era," the firm stated.

"At the same time, in the biggest industry reset since deregulation, the integrated telco is giving way to more disaggregated, narrowly focused business models."

In 2024, $22b of the global telecom M&A value ($128b) came from deals in Asia Pacific.