Telecom sector falls short between 2019 and 2022: BCG

Telco companies registered an average of 9% in annual returns.

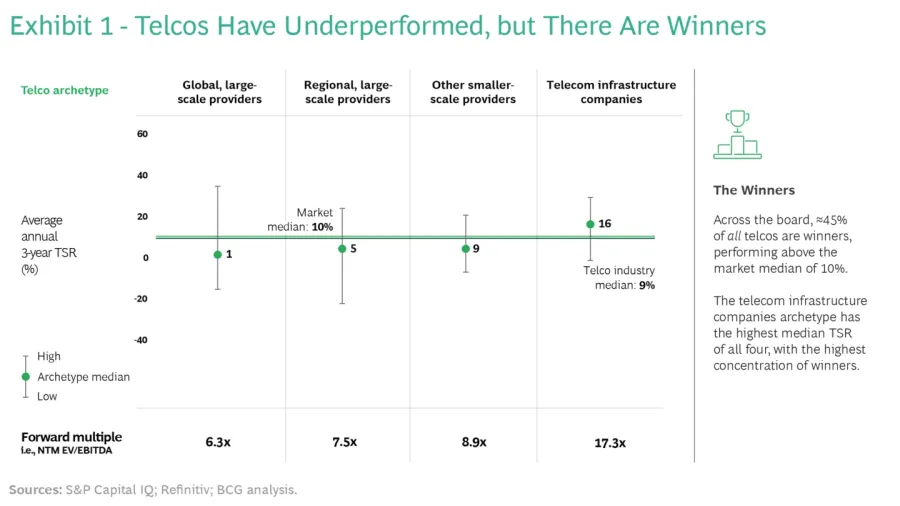

An analysis of total shareholder return (TSR) from 2019 to 2022 showed that telcos delivered a middling performance with an average annual return of 9%, Boston Consulting Group (BCG) reported.

This is a point lower than the overall equities market, the BCG report also noted.

The telecommunications sector played a central role in global technology trends and was the essential thread connecting people, businesses, and whole societies during the COVID-19 pandemic.

Despite this, the sector has been unable to achieve returns similar to those seen in other sectors. The rise of Web3, the emergence of Gen Z, intensifying competition from “hyperscalers,” 5G-enabled B2B applications, and the potential in structural separation are set to transform telecommunications, representing an enormous opportunity if navigated correctly.

Lean and digitized operations with excess costs rooted out, a coherent portfolio of products and services, strong customer support built upon aggressively priced products and services, and network investments in 5G, fixed wireless, fiber optics, and other upgrades are some of the traditional strategies that successful telcos have in common. However, these will not be sufficient to drive outsized results in the future given five trends that are set to upend business as usual.

BCG’s analysis reveals that these returns are boosted by pure-play telecom infrastructure companies, whose median annual TSR topped the market by 6 percentage points. However, the other three telco archetypes examined, which include global, large-scale providers, regional, large-scale providers, and small-scale providers, underperformed the market, although a handful of companies within each archetype did better than the average.

Read more: Telecom operators should offer more than just connectivity to increase revenue

Five trends stand out as having the most potential impact—good or bad—on future revenue and operating income of telcos. The widespread emergence of Web3 will transform consumer and business activities beyond what 5G is offering now.

Telcos must begin to anticipate which parts of their markets are threatened by Web3 rivals, the value of these customer segments and how they can invest proactively in new applications that provide innovative and feature-rich Web3 uses and enhanced revenue streams.

The rise of Gen Z, the age group between ten and 25 years old now, represents a radical opportunity for telcos, that target Gen Z preferences while simultaneously being a risk that technology startups and innovators will squeeze telcos out before they make inroads with these new customers.

The big tech companies are stretching beyond their original markets, which is increasing the competition for telcos. Telcos have no choice but to out-create the tech companies and develop applications more attractive to consumers and businesses. This will require significant investment in innovation or forging partnerships with other companies that have a foothold in these new markets.

Although 5G networks are already making limited inroads among consumers, particularly for gaming, video, and early-stage virtual reality devices, they may leave a much bigger footprint among business customers.

In summary, the telecom sector is facing a series of short-term shocks and long-term trends that will force companies to revisit their traditional strategic approaches. The telecom industry must innovate and anticipate the upcoming changes to compete with its rivals.

If navigated correctly, these five trends represent an enormous opportunity that could significantly change the trajectory for telcos, producing years of solid, above-market returns.

"We believe that while short-term performance for some of the more traditional telecommunications companies might be volatile, there are still opportunities for growth and above-market returns over the long-term. By leveraging these trends, companies can build a portfolio that delivers innovative and superior customer experiences, provides targeted, high-quality content and applications, and generates substantial revenue streams," Joerg Staeglich, a BCG principal and report coauthor said.