Data centres to serve as 'growth engine' for Asia Pacific telcos

Telecom firms in the region increasingly investing in data facilities.

S&P Global believes data centres will drive growth in many telecommunications companies and real estate firms in Asia Pacific amidst the ongoing data centre boom in the region.

"Asia Pacific data centres are swinging into investors' view," noted S&P, which cited accelerated expansion as the main trend for these data centres.

"We estimate more than US$100b will be invested in such facilities in the region over the next five years. The spending will capitalise on strong data growth and the rise in AI (artificial intelligence), cloud computing, and digitalisation."

S&P Global Market Intelligence 451 Research estimates that the region's data centre capacity will likely grow at a compound annual rate of 17% through to 2029.

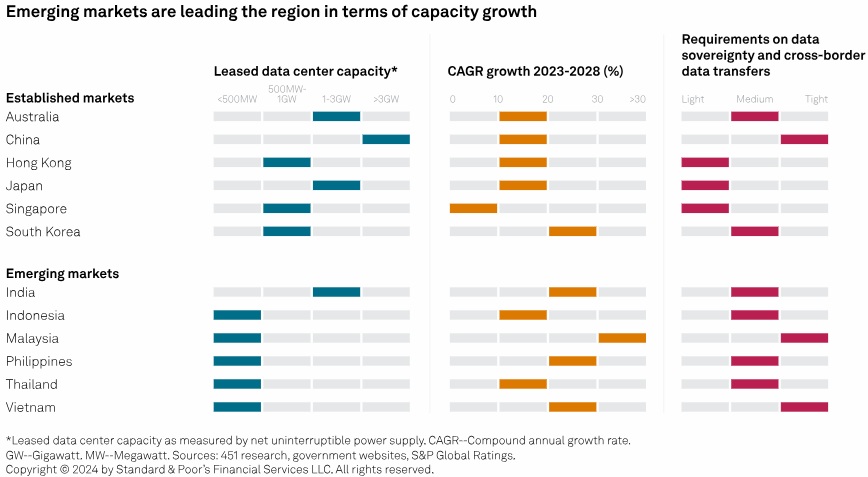

Notably, emerging markets (e.g., India, Indonesia, Malaysia, the Philippines, Thailand, and Vietnam) are expected to outpace their more established counterparts (e.g., Australia, China, Hong Kong, Japan, Singapore, and South Korea) in terms of medium-term capacity growth.

Reasons for the investor preference include the significant boost in data demand as a result of digitalisation, government support for setting up local data centres, and the lower costs to develop and operate such facilities in emerging markets.

In Malaysia, for instance, Johor Bahru is serving as a cheaper alternative to Singapore's data centre sites.

Sector-wise, S&P pointed out: "Rated telecom companies in the region are also increasingly investing in, and operating, data centres. They will be the growth engine for many telecoms and real estate companies."