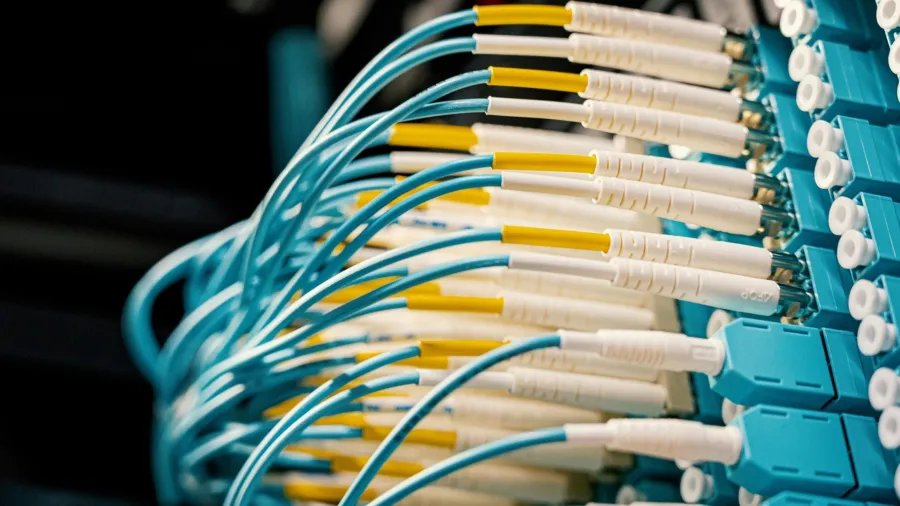

Fibre broadband leads fixed communications services market in APAC

Adoption driven by rising demand and competitively priced plans.

"By 2030, fibre-optic access lines will account for a share of about 87% of the total fixed access lines in the developed APAC (Asia Pacific) region, whilst their share in the total fixed lines in the emerging APAC markets will be slightly higher at 90%."

That was the assertion made by GlobalData Telecom Analyst Kantipudi Pradeepthi when the data and analytics company reported that fixed communications service revenue in the region would likely grow from this year's $386b to $405b in 2030 at a compound annual growth rate (CAGR) of 1%.

According to GlobalData, the growth will be backed by continued increases in fixed broadband subscriptions and will be mainly driven by the fibre broadband segment.

"APAC is a moderately developed region in terms of fixed broadband adoption, with fixed broadband account penetration reaching 22.6% at year-end 2025," GlobalData pointed out.

"By 2030, fixed broadband penetration is set to reach 24.6%, driven by the ongoing broadband network expansions and growing adoption in emerging countries like Philippines, Malaysia, and India, where governments are infusing investments in fixed broadband infrastructure development."

In the Philippines, telco giant PLDT is improving data transmission from the Asia Direct Cable system to local end users with the help of Ciena's optical technology. Meanwhile, in Malaysia, broadband coverage has been expanded to nearly 98% of populated areas. In India, the goal is to provide subsidised connectivity to millions of rural households by 2027.

As for the developed side of APAC, GlobalData cited the likes of Australia, New Zealand, and Singapore for their national broadband network projects that mean high broadband penetration. In China, pilot projects for 10-gigabit optical networks were launched earlier this year.

Read more: Australian telcos to benefit from M2M/IoT connectivity trends

"Rising demand for high-speed internet services and competitively priced fibre broadband plans from operators with benefits like unlimited internet and access to major subscription video on demand platforms will drive the fibre broadband service adoption in the region," said Pradeepthi, who added that firms such as Reliance Jio India, Spark New Zealand, and Telstra Australia were bundling fibre plans with value-added services.