What is driving growth in Japan's telecom sector?

Industry players cited for their network expansion efforts.

Developments in fibre technology and increased 5G adoption in Japan are advancing the country's push for digital connectivity, according to data and analytics firm GlobalData.

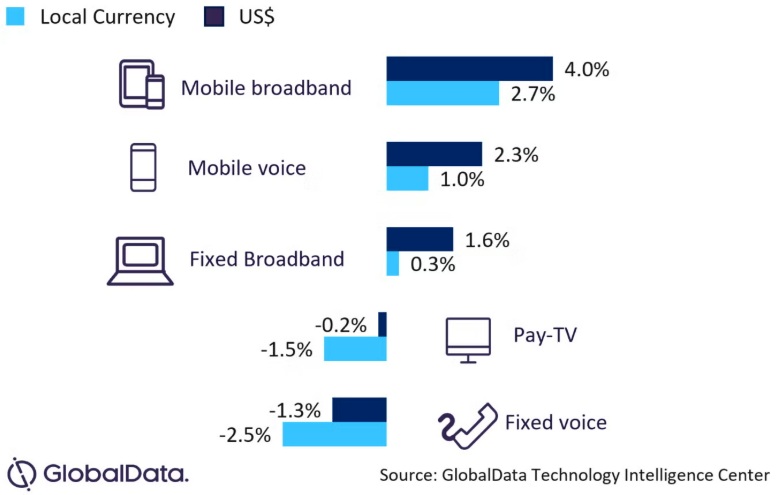

Releasing its "Japan Telecom Operators Country Intelligence Report," GlobalData said Japan's telecom and pay-TV services revenue is poised to improve during 2024-2029 at a compound annual growth rate (CAGR) of 2.2%. Mobile data service, in particular, is forecast to grow from 2024's $37.8 billion to $45.9 billion come 2029.

Contributing to the market expansion is the ongoing rise in smartphone subscriptions and mobile internet usage. Along with the growing demand, mobile network operators' (MNOs) earnings also get a boost from higher ARPU-yielding (average revenue per user) premium 5G plans.

"4G services accounted for the largest share of mobile services market, in terms of subscriptions, in 2024," noted Neha Mishra, telecom analyst at GlobalData. "However, its share will decline over the forecast period due to the continued migration of subscribers to 5G services."

Citing the work being done by market players, GlobalData highlighted: "Growth in 5G subscriptions will be supported by the ongoing 5G network expansion efforts of all major MNOs and the growing availability and affordability of 5G smartphones and segmented 5G plans.

"For instance, KDDI and SoftBank plan to expand their 5G networks by jointly building 100,000 base stations each by March 2031, through their 5G Japan Corporation joint venture."

It went on to add: "NTT led both the mobile and fixed communication services market in Japan in 2024 and will maintain its lead, given its strong focus on technology innovation and advancements.

"The telco is actively engaged in the research and development for 5G evolution and 6G technologies. For instance, in July 2024, NTT launched Japan's fastest 5G standalone service, achieving download speeds up to 6.6 Gbps (gigabits per second)."

In Japan, where the goal is to achieve 99.9% fibre coverage by 2027, the National Institute of Information and Communications Technology set a global broadband speed record of 402 terabits per second in July 2024.

"Japan's strong focus on R&D (research and development) and infrastructure modernisation, from 5G standalone to next-gen fibre optics, will play a pivotal role in shaping the country's digital future," Mishra commented.

"Operators that leverage this innovation to create tailored, high-value offerings will secure long-term subscriber loyalty and unlock new monetisation opportunities in an increasingly competitive market."