Telco, pay-TV revenue to boost market to $18.8b by 2028 in Indonesia

Mobile data, fibre subscription growth drive gains amidst digital transformation.

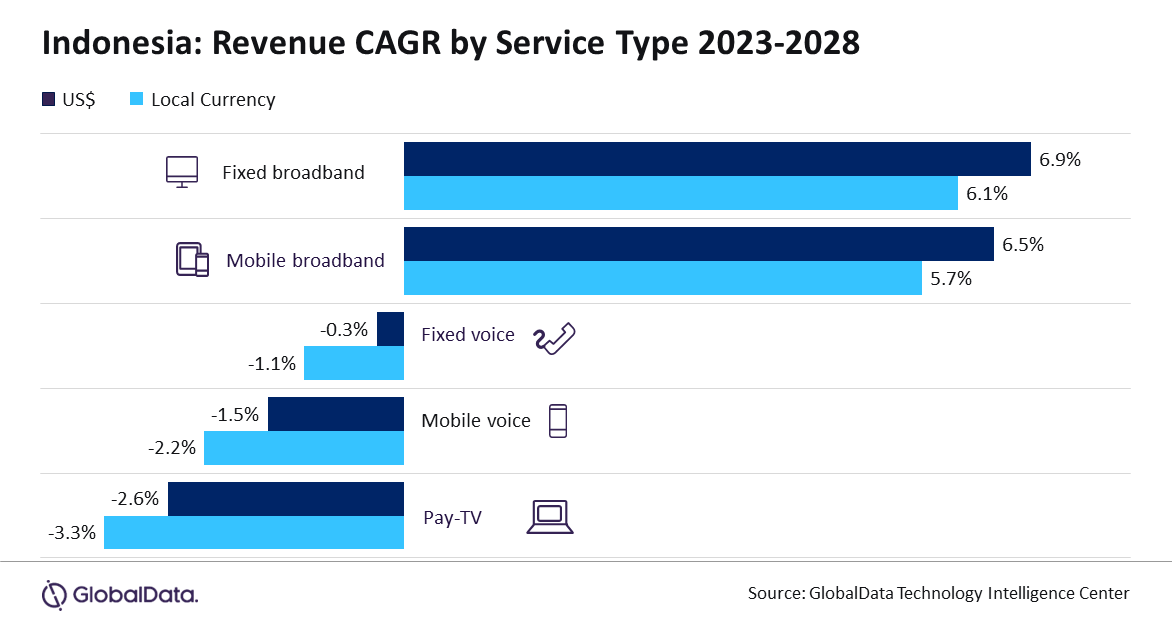

Indonesia’s increasing adoption of 4G and 5G services, along with steady growth in fibre broadband subscriptions, is expected to drive total telecommunications and pay-TV services revenue from $15.1b in 2023 to $18.8b by 2028, according to GlobalData.

Mobile data service revenue in the country will continue to rise, driven by growth in mobile internet subscriptions, an increase in 4G adoption, and the expanding use of higher average revenue per user (ARPU)-yielding 5G services between 2023 and 2028.

Sarwat Zeeshan, a telco analyst at GlobalData, said 4G will remain the dominant mobile technology in Indonesia through 2028 in terms of subscription share.

This is due to the Indonesian Ministry of Communications and Informatics’ push for the shutdown of 3G services whilst mobile network operators continue to expand 4G/LTE coverage.

“With the ongoing 5G network upgrades and plans for more widespread 5G network rollouts by the operators, 5G services will go on to account for more than 20.8% of total mobile subscriptions in the country by 2028,” Zeeshan said.

Conversely, mobile voice service revenue is expected to decline over the forecast period due to the bundling of free voice minutes in mobile service plans, the increasing use of OTT-based communication apps for voice calls, and a subsequent drop in mobile voice ARPU.

In the fixed communication services segment, fixed voice revenue is also expected to decrease as more customers switch to mobile and internet-based voice communication services.

However, fixed broadband services revenue is set to expand at a compound annual growth rate of 6.9% from 2023 to 2028, supported by rising fibre broadband subscriptions and continued network expansion.

“The growing demand for high-speed broadband connectivity and ongoing fibre-optic infrastructure expansions in the country will support the growth in fibre broadband subscriptions over the forecast period,” Zeeshan added.

Meanwhile, the report showed that the pay-TV service segment’s revenue will decline due to a continued drop in cable TV subscriptions and a decrease in total pay-TV service ARPU.