Technology, media and telecom deals surge in H1

It beat the global energy and materials sector as the most active.

Technology, media and telecom (TMT) mergers & acquisitions (M&A) deal value surged 39% in the first half of the year, beating the global energy and materials (GEM) sector as the most active, a report by McKinsey revealed

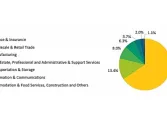

According to the Rich in resilience: Dealmakers deliver strong first-half results in M&A article, TMT, GEM, and financial institutions account for 59% of the value deals in H1.

TMT transactions dominated the most in the Americas, boosted by increasing interest in harnessing some of the exploding developments in AI.

Meanwhile, financial institutions were the biggest contributor to M&A activity in EMEA, driven by a few large, announced deals in banking and insurance, whilst healthcare deals also increased sharply in the region, up 95% from a year earlier. Meanwhile, GEM transactions dominated in Asia Pacific.

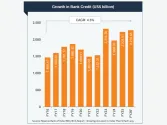

Global deals over $25m rose 22% to $2t in the first half of the year, driven by a surge in megadeals, even as overall deal volume held steady at just over 3,700.